The people of India have reposed their faith in the government led by the Narendra Modi and re-elected it for a historic third term under his leadership.

The global economy, while performing better than expected, is still in the grip of policy uncertainties.

India’s economic growth on the other hand continues to be the shining exception. India’s inflation continues to be low, stable, and moving towards the 4 per cent target. Core inflation (non-food, non-fuel) currently is 3.1 per cent.

Table of Contents

Highlights of Union Budget 2024-25

For the year 2024-25, the total receipts other than borrowings estimated at 32.07 lakh crores and the total expenditure are 48.21 lakh crores respectively. The net tax receipts are estimated at 25.83 lakh crores. The fiscal deficit is estimated at 4.9 per cent of GDP.

The gross market borrowings estimated at 14.01 lakh crores and net market borrowings through dated securities during 2024-25 are 11.63 lakh crores respectively. Both will be less than that in 2023-24.

Taking Interim Budget Forward

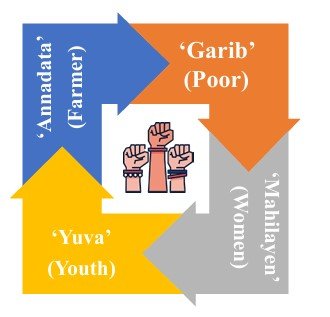

As mentioned in the interim budget, Government to focus on 4 major castes, namely which are also in focus in Union Budget 2024-25.

- ‘Garib’ (Poor),

- ‘Mahilayein’ (Women),

- ‘Yuva’ (Youth) and

- ‘Annadata’ (Farmer).

Union Budget 2024-25 Priorities

In the interim budget, government promised to present a detailed roadmap for our pursuit of ‘Viksit Bharat’ this budget envisages sustained efforts on the following 9 priorities for generating ample opportunities for all.

- Productivity and resilience in Agriculture

- Employment & Skilling

- Inclusive Human Resource Development and Social Justice

- Manufacturing & Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research & Development and

- Next Generation Reforms

Priority 1 of Union Budget 2024-25: Productivity and Resilience in Agriculture

A provision of ` 1.52 lakh crores for agriculture and allied sector.

Transforming agriculture research

Funding will be provided in challenge mode, including to the private sector. Domain experts both from the government and outside will oversee the conduct of such research.

Release of new varieties

New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation by farmers.

Natural Farming

In the next two years, 1 crore farmers across the country will initiate natural farming supported by certification and branding. Implementation will be through scientific institutions and willing gram panchayats. 10,000 need-based bio-input resource centres will be established.

Missions for pulses and oilseeds

For achieving self-sufficiency in pulses and oilseeds, government will strengthen their production, storage and marketing.

Vegetable production & Supply Chains

Large scale clusters for vegetable production will be developed closer to major consumption centres.

Digital Public Infrastructure for Agriculture

Implementation of the Digital Public Infrastructure (DPI) in agriculture for coverage of farmers and their lands in 3 years. During this year, digital crop survey for Kharif using the DPI will be taken up in 400 districts. The details of 6 crore farmers and their lands will be brought into the farmer and land registries. Further, the issuance of ‘Jan Samarth based Kisan Credit Cards’ will be enabled in 5 states.

Shrimp Production & Export

Financial support for setting up a network of Nucleus Breeding Centers for Shrimp Brood stocks will be provided.

Priority 2 of Union Budget 2024-25: Employment & Skilling

Skilling programme

Skilling 20 lakh youth over a 5-year period in collaboration with state governments and Industry in 1,000 Industrial Training Institutes.

Skilling Loans

The Model Skill Loan Scheme will be revised to facilitate loans up to

7.5 lakh with a guarantee from a government promoted Fund. This measure is expected to help 25,000 students every year.

Education Loans

A financial support for loans up to 10 lakh for higher education in domestic institutions. E-vouchers for this purpose will be given directly to 1 lakh students every year for annual interest subvention of 3 per cent of the loan amount.

Employment Linked Incentive

following 3 schemes for ‘Employment Linked Incentive’, as part of the Prime Minister’s package. These will be based on enrolment in the EPFO, and focus on recognition of first-time employees, and support to employees and employers.

Scheme A: First Timers

This scheme will provide one-month wage to all persons newly entering the workforce. The direct benefit transfers of one-month salary in 3 instalments to first-time employees registered in the EPFO, will be up to Rs. 15,000/-. The eligibility limit will be a salary upto 1 lakh per month. The scheme is expected to benefit 2.10 crores youth.

Scheme B: Job Creation in manufacturing

This scheme will incentivize additional employment in the manufacturing sector, linked to the employment of first-time employees. An incentive will be provided directly both to the employees and the employers with respect to their EPFO contribution in the first 4 years of employment. The scheme is expected to benefit 30 lakh youth entering employment, and their employers.

Scheme C: Support to employers

This employer-focussed scheme will cover additional employment in all sectors. All additional employment within a salary of 1 lakh per month will be counted. The government will reimburse to employers up to 3,000/- per month for 2 years towards their EPFO contribution for each additional employee. The scheme is expected to incentivize additional employment of 50 lakh persons.

Priority 3 of Union Budget 2024-25: Inclusive Human Resource Development and Social Justice

Purvodaya

For all-round development of the eastern region of the country covering Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh. This will cover human resource development, infrastructure, and generation of economic opportunities.

PM Awas Yojana

Three crore additional houses under the PM Awas Yojana in rural and urban areas in the country have been announced.

Pradhan Mantri Jan-jatiya Unnat Gram Abhiyan

saturation coverage for tribal families in tribal-majority villages and aspirational districts covering 63,000 villages benefitting 5 crore tribal people.

Bank branches in North-Eastern Region

More than 100 branches of India Post Payment Bank will be set up in the North East region to expand the banking services.

Priority 4 of Union Budget 2024-25: Manufacturing & Services

Credit Guarantee Scheme for MSMEs in the Manufacturing Sector

For facilitating term loans to MSMEs for purchase of machinery and equipment without collateral or third-party guarantee, a self-financing credit guarantee scheme that cover up to 100 crores, while the loan amount may be larger.

New assessment model for MSME credit

Public sector banks will build their in-house capability to assess MSMEs for credit, that will also cover MSMEs without a formal accounting system.

Mudra Loans

The limit of Mudra loans will be enhanced to ₹20 lakh from the current ₹10 lakh for those entrepreneurs who have availed and successfully repaid previous loans under the ‘Tarun’ category.

Enhanced scope for mandatory on boarding in TReDS

Government reduced the turnover threshold of buyers for mandatory on boarding on the TReDS platform from ` 500 crores to ` 250 crores.

SIDBI branches in MSME clusters

SIDBI will open new branches to expand its reach to serve all major MSME clusters within 3 years, and provide direct credit to them. With the opening of 24 such branches this year, the service coverage will expand to 168 out of 242 major clusters.

MSME Units for Food Irradiation, Quality & Safety Testing

Financial support for setting up of 50 multi-product food irradiation units in the MSME sector will be provided. Setting up of 100 food quality and safety testing labs with NABL accreditation will be facilitated.

E-Commerce Export Hubs

To enable MSMEs and traditional artisans to sell their products in international markets, E-Commerce Export Hubs will be set up in public-private-partnership (PPP) mode.

Measures for promotion of Manufacturing & Services

Internship in Top Companies

As the 5th scheme under the Prime Minister’s package, government will launch a comprehensive scheme for providing internship opportunities in 500 top companies to 1 crore youth in 5 years. They will gain exposure for 12 months to real-life business environment, varied professions and employment opportunities. An internship allowance of 5,000/- per month along with a one-time assistance of 6,000/- will be provided.

Companies will be expected to bear the training cost and 10 per cent of the internship cost from their CSR funds.

Industrial Parks

In near 100 cities, in partnership with the states and private sector, by better using town planning schemes.

Twelve industrial parks under the National Industrial Corridor Development Programme also will be sanctioned.

Rental Housing

Rental housing with dormitory type accommodation for industrial workers will be facilitated in PPP mode with VGF support and commitment from anchor industries.

Critical Mineral Mission

Government will set up a Critical Mineral Mission for domestic production, recycling of critical minerals, and overseas acquisition of critical mineral assets.

Digital Public Infrastructure Applications

At population scale for productivity gains, business opportunities, and innovation by the private sector. These are planned in the areas of credit, e-commerce, education, health, law and justice, logistics, MSME, services delivery, and urban governance.

Integrated Technology Platform for IBC eco-system

An Integrated Technology Platform will be set up for improving the outcomes under the Insolvency and Bankruptcy Code (IBC) for achieving consistency, transparency, timely processing and better oversight for all stakeholders.

Voluntary closure of LLPs

The services of the Centre for Processing Accelerated Corporate Exit (C-PACE) will be extended for voluntary closure of LLPs to reduce the closure time.

Priority 5 of Union Budget 2024-25: Urban Development

Transit Oriented Development

Transit Oriented Development plans for 14 large cities with a population above 30 lakhs will be formulated, along with an implementation and financing strategy.

Urban Housing

Under the PM Awas Yojana Urban 2.0, housing needs of 1 crore urban poor and middle-class families will be addressed with an investment of 10 lakh crore. This will include the central assistance of 2.2 lakh crore in the next 5 years.

Water Supply and Sanitation

Government will promote water supply, sewage treatment and solid waste management projects and services for 100 large cities through bankable projects. These projects will also envisage use of treated water for irrigation and filling up of tanks in nearby areas.

Street Markets

Over the next five years, development of 100 weekly ‘haats’ or street food hubs in select cities.

Priority 6 of Union Budget 2024-25: Energy Security

PM Surya Ghar Muft Bijli Yojana

In line with the announcement in the interim budget, PM Surya Ghar Muft Bijli Yojana has been launched to install rooftop solar plants to enable 1 crore households obtain free electricity up to 300 units every month. The scheme has generated remarkable response with more than 1.28 crore registrations and 14 lakh applications.

Research and development of small and modular nuclear reactors

Government will partner with the private sector for

(1) setting up Bharat Small Reactors

(2) research & development of Bharat Small Modular Reactor

(3) research & development of newer technologies for nuclear energy.

Priority 7 of Union Budget 2024-25: Infrastructure

This year, Government has provided 11,11,111 crores around 3.4 per cent of our GDP for capital expenditure.

Pradhan Mantri Gram Sadak Yojana (PMGSY)

Phase IV of PMGSY will be launched to provide all-weather connectivity to 25,000 rural habitations which have become eligible in view of their population increase.

Tourism

Tourism has always been a part of our civilization. Our efforts in positioning India as a global tourist destination will also create jobs, stimulate investments and unlock economic opportunities for other sectors.

Comprehensive development of Vishnupad Temple Corridor and Mahabodhi Temple Corridor will be supported.

A comprehensive development initiative for Rajgir will be undertaken.

Government will support the development of Nalanda as a tourist centre besides reviving Nalanda University to its glorious stature.

Priority 8 of Union Budget 2024-25: Innovation, Research & Development

Government will operationalize the Anusandhan National Research Fund for basic research and prototype development.

Space Economy

Expanding the space economy by 5 times in the next 10 years, a venture capital fund of 1,000 crores will be set up.

Priority 9 of Union Budget 2024-25: Next Generation Reforms

A significant part of the 50-year interest-free loan. Working with the states, we will initiate the following reforms.

Rural Land related actions

Rural land related actions will include

(1) assignment of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands.

(2) digitization of cadastral maps

(3) survey of map sub-divisions as per current ownership

(4) establishment of land registry

(5) linking to the farmers registry.

Urban Land related actions

Land records in urban areas will be digitized with GIS mapping.

Labour related reforms

Services to Labour

Government will provide a wide array of services to labour, including those for employment and skilling.

A comprehensive integration of e-shram portal with other portals will facilitate such one-stop solution.

Shram Suvidha and Samadhan portals will be revamped to enhance ease of compliance for industry and trade.

NPS Vatsalya

A plan for contribution by parents and guardians for minors will be started. On attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

Changes in taxes the Union Budget 2024-25

CHANGES IN INDIRECT TAX

- Medicines and Medical Equipment

- To provide relief to cancer patients, three more medicines fully exempted from customs duties.

- Mobile Phone and Related Parts

- Government has reduced the Basic Custom Duty on mobile phone, mobile PCBA and mobile charger to 15 per cent.

- Critical Minerals

- Government fully exempted customs duties on 25 critical minerals and reduce Basic Custom Duty on two of them.

- Marine products

- Government has reduced Basic Custom Duty on certain brood stock, Polychaeta worms, shrimp and fish feed to 5 per cent and exempt customs duty on various inputs for manufacture of shrimp and fish feed.

- Precious Metals

- Government has reduced customs duties on gold and silver to 6 per cent and that on platinum to 6.4 per cent.

- Other Metals

- Government has removed the Basic Custom Duty on Ferro nickel and blister copper and nil Basic Custom Duty on ferrous scrap and nickel cathode and concessional Basic Custom Duty of 2.5 per cent on copper scrap.

- Electronics

- Government has removed the Basic Custom Duty, on oxygen free copper for manufacture of resistors.

CHANGES IN DIRECT TAXES in Union Budget 2024-25

- Simplification for Charities and of TDS

- Simplification of Reassessment

- Simplification and Rationalization of Capital Gains

- Short term gains on certain financial assets shall attract a tax rate of 20 per cent.

- Long term gains on all financial and non-financial assets, will attract a tax rate of 12.5 per cent. To benefit of the lower and middle-income classes government has increased the limit of exemption of capital gains on certain financial assets to 1.25 lakh per year.

- Listed financial assets held for more than 1 year will be classified as long term.

- Unlisted financial assets and all non-financial assets will have to be held for at least two years to be classified as long-term.

- Litigation and Appeals

- Vivad Se Vishwas Scheme, 2024 For resolution of certain income tax disputes pending in appeal.

- Government has increased monetary limits for filing appeals related to direct taxes, excise and service tax in the Tax Tribunals, High Courts and Supreme Court to 60 lakhs, 2 crores and 5 crores respectively.

- Lowering Corporate Tax

- Government has reduced the corporate tax rate on foreign companies from 40 to 35 per cent.

- Deepening the tax base

- Security Transactions Tax on futures and options of securities is proposed to be increased to 0.02 per cent and 0.1 per cent respectively.

Other Major Announcements in Union Budget 2024-25

- To improve social security benefits, deduction of expenditure by employers towards NPS is proposed to be increased from 10 to 14 per cent of the employee’s salary. Similarly, deduction of this expenditure up to 14 per cent of salary from the income of employees in private sector, public sector banks and undertakings, opting for the new tax regime.

- For Indian professionals working in multinationals get ESOPs and invest in social security schemes and other movable assets abroad. non-reporting of movable assets up to 20 lakhs is proposed to be de-penalized.

- Withdrawal of equalization levy of 2 per cent;

Changes in Personal Income Tax in Union Budget 2024-25

- The standard deduction for salaried employees is proposed to be increased from 50,000/- to 75,000/-.

- Deduction on family pension for pensioners is proposed to be enhanced from 15,000/- to 25,000/-.

- In the new tax regime, the tax rate structure is proposed to be revised, as follows:

| 0-3 lakh rupees | Nil |

| 3-7 lakh rupees | 5 per cent |

| 7-10 lakh rupees | 10 per cent |

| 10-12 lakh rupees | 15 per cent |

| 12-15 lakh rupees | 20 per cent |

| Above 15 lakh rupees | 30 per cent |

As a result of these changes, a salaried employee in the new tax regime stands to save up to 17,500/- in income tax.

Union Budget 2024-25 of future

Union Budget 2024-25 is like a well-choreographed Bollywood dance sequence: a mix of drama, rhythm, and a dash of optimism it has something for everyone.

READ ABOUT INDIAN OLYMPICS HISTORY

Comment your feedback on this blog and join us for more informative blogs like this.

Thank You.

Pingback: Futuristic PM's Package for Indian Youth in Budget 2024